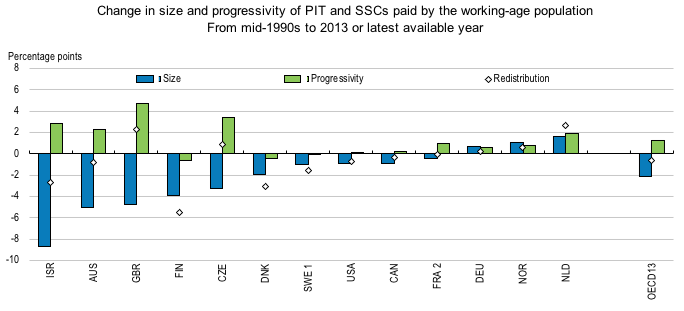

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

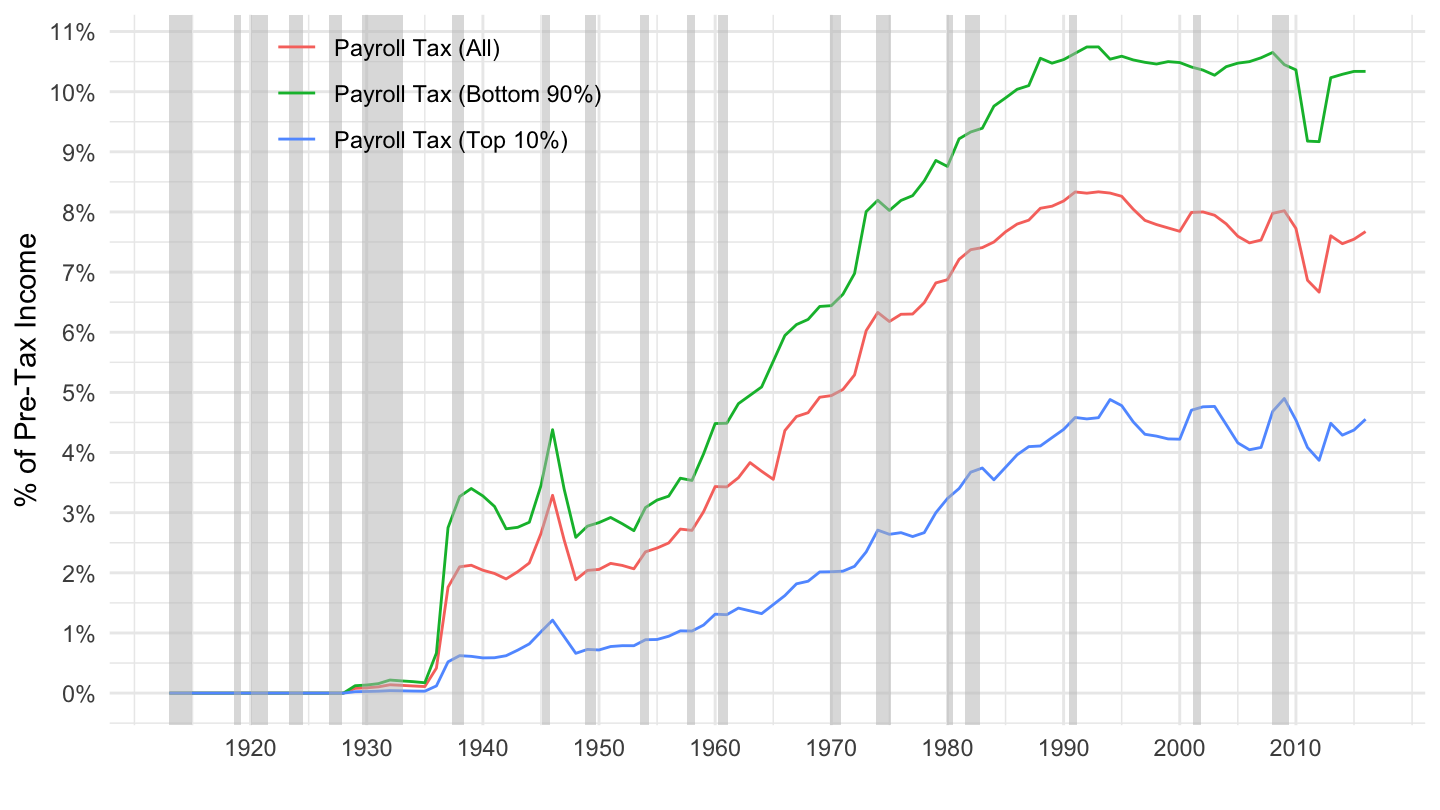

Has the redistributive effect of social transfers and taxes changed over time across countries? - Caminada - 2019 - International Social Security Review - Wiley Online Library